Typically, when removing a claim payment or receipt payment from the Transaction History, you wouldn't want to delete the payment entirely. If it was created in a prior reporting period, this would impact past financials.

If you have the company setting Removal of payments is done using the reversal process set to Yes, removing claim/receipt payments from the Transaction History screen is instead done through a reversal -- it creates a new, reversing payment line that offsets the original, but with the current post date.

To do this, take the following steps:

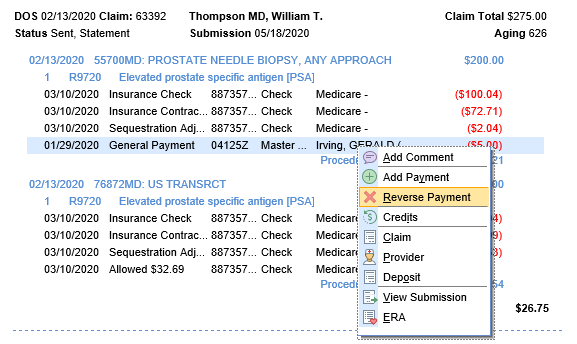

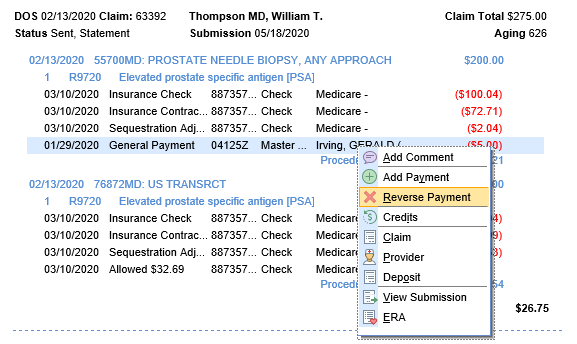

- Right-click on the claim/receipt payment you want to remove, and select Reverse Payment.

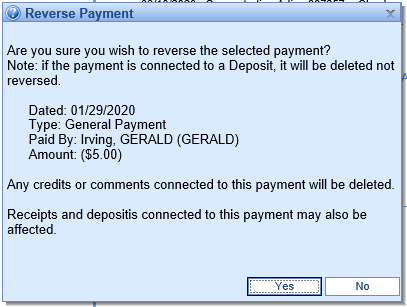

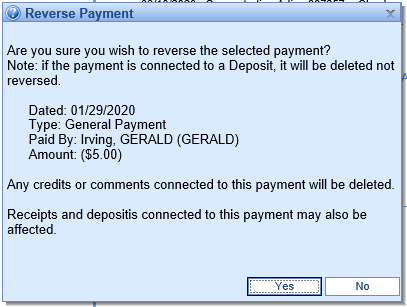

- Verify the information is correct for the line you'd like to reverse, and click Yes:

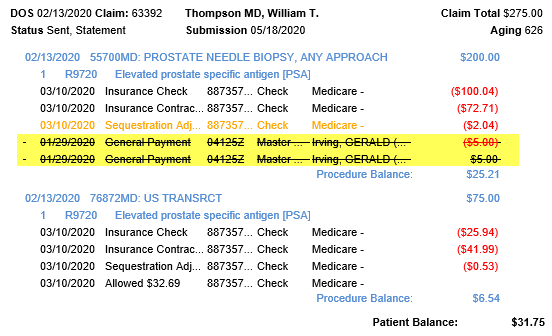

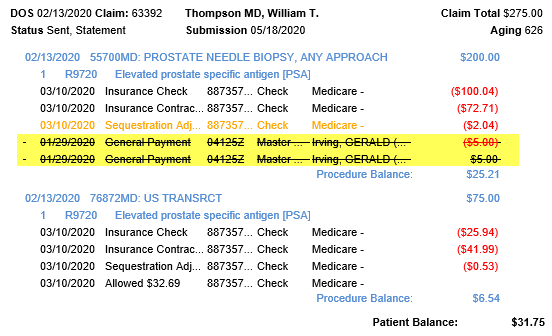

- Note that there is now a strike-through on the payment line which was reversed, as well as through the line denoting the reversal. It has also increased the balance on my claim correctly:

If the payment is associated with a deposit, it will be deleted instead of reversed.

If the payment is associated with a receipt, the unapplied amount on the receipt will increase and the money can be applied again. If the receipt was in a Completed status, it will revert to Error status.

If the payment is not associated with a receipt or a deposit, then nothing further will happen.